Hi Marketing Wranglers,

This week’s issue is packed with seismic shifts that could reshape how you market, price, and deploy AI in customer experiences. We’re diving into the political battle over who controls AI laws in America, breaking down what the FTC’s war on hidden fees means for your ad strategy, and unpacking Klarna’s unexpected pivot back to human customer support.

New Slack Community:

Marketing, Compliance, and Legal are all feeling the heat—so we’re launching a community space on Slack to swap updates, share insights, and stay ahead together. Join the community here.

🚨 In This Week’s Issue

⚖️ The AI Regulation Showdown: Why 40 states are fighting a federal 10-year freeze—and what it means for your AI compliance playbook.

💸 The Surprise Fee Is Dead: With the FTC’s new rule in play, transparent pricing isn’t just legal—it’s a competitive edge.

🤖↩️ Klarna’s AI Reversal: From 700 layoffs to a human-powered comeback—how new laws and bad bot support forced a fintech rethinks.

Tune In: Marketing Under Fire: Surviving the CFPB’s New Era [Webinar]

May 29 @ 3 pm ET | LinkedIn

We’ll cover:

- What the BNPL rollback means for marketing claims and disclosures

- How state regulators and advocacy groups are stepping into the vacuum

- Common compliance risks that are still getting flagged

- How leading fintech teams are adjusting review processes with AI

If you’re responsible for customer-facing content in financial services, this is a session you won’t want to miss.

RSVP on LinkedIn.

⚖️ The AI Regulation Showdown Update: States vs Federal Government

A political battle is brewing over who gets to regulate artificial intelligence, and the stakes couldn't be higher. As we covered last week, buried in President Trump's tax cut bill is a provision that would freeze all state AI regulations for a decade – and it's sparked a rare bipartisan uprising from state attorneys general.

The 10-Year Freeze

The Republican proposal would essentially hit the pause button on AI regulation at the state level, blocking the patchwork of laws that dozens of states have already passed. Think of it as a regulatory timeout while the federal government figures out its own approach, backed by $500 million in funding.

House Republicans argue this makes perfect sense. As California Rep. Jay Obernolte put it, trying to comply with "1,000 different pending bills in state legislatures" would be impossible for companies operating nationwide. (Unless they have Warrant that is). Google agrees, calling the moratorium "an important first step" for national security and AI leadership.

But here's where it gets interesting: 40 state attorneys general – including Republicans from Ohio, Tennessee, Arkansas, Utah, and Virginia – have joined forces with Democrats to oppose the measure. When politicians from red and blue states unite against something, you know it's struck a nerve.

California's Attorney General Rob Bonta, representing the state that houses AI giants like OpenAI and Google, didn't mince words: "States must be able to protect their residents by responding to emerging and evolving AI technology."

What's Already at Stake

California's recent AI laws show exactly what would be frozen under this moratorium. The state has criminalized AI-generated deepfake pornography, banned unauthorized AI in political ads, required healthcare providers to disclose when patients are talking to AI instead of humans, and prohibited insurance companies from using AI to make medical necessity decisions.

These aren't abstract regulations – they're responses to real problems happening right now. The question is whether a 10-year federal freeze is worth the trade-off of potentially leaving consumers unprotected.

What’s Next?

The measure still faces significant hurdles. It passed the House, but it needs to survive the Senate and pass through budget reconciliation – a process meant for budget items, not sweeping regulatory changes. The bipartisan opposition from state officials suggests this won't be an easy fight.

Should states be free to protect their residents from AI risks as they see fit, or does the rapidly evolving nature of AI require a unified national approach (despite very little action on this front)? The answer will shape how America governs its AI future for the next decade.

Read more on Yahoo! Tech.

💸 The Surprise Fee Is Dead: FTC Bans Hidden Charges

May 12 marked the end of an era—and the beginning of a compliance scramble.

The Federal Trade Commission's Rule on Unfair or Deceptive Fees didn't just quietly slip into effect; it landed like a regulatory earthquake across the ticketing, hospitality, and rental industries.

For marketers who've spent years perfecting the art of the "$29*" asterisk dance, this isn't just another legal memo to file away—it's a fundamental shift that's already reshaping how brands communicate value, build trust, and design user experiences.

The Death of the Checkout Surprise

Gone are the days when a $99 hotel room could magically balloon to $150 at the final click. The new rule cuts straight to the heart of consumer frustration: all mandatory fees must be displayed upfront, prominently, and without games.

This isn't about adding a small disclaimer or tucking fees into fine print. The FTC demands that total prices become the most prominent pricing element across every customer touchpoint—from your first Google ad impression to the final booking confirmation.

Those familiar "convenience fees," "processing charges," and "service fees" that have quietly padded revenues? They're not banned, but they must be explained clearly and shown early in the customer journey.

The rule draws a critical distinction that smart marketers are already exploiting: optional fees (think expedited shipping or room upgrades) can still be presented separately, but only when clearly flagged as add-ons before payment processing begins.

Beyond Ticketmaster: Who's Really in the Crosshairs

While Ticketmaster and StubHub headlines dominate the conversation, the rule's reach extends far beyond entertainment venues. Hotel chains, vacation rental giants like Airbnb and VRBO, travel booking platforms, and even fintechs now operate under the same transparency mandate.

For marketing teams supporting any of these verticals, this represents a massive operational shift. Campaign strategies built around attractive entry-point pricing must now account for total costs from day one—a change that's already forcing some companies to completely reimagine their acquisition funnels.

Where Marketing Meets Compliance Reality

This rule transforms what was once a back-office pricing discussion into a frontline marketing agenda:

Creative Asset Overhaul: Every piece of promotional content—from Instagram Stories to email subject lines—must now reflect accurate total pricing. Marketing teams are discovering that their entire creative library may need rebuilding to avoid deceptive advertising claims.

User Experience Redesign: The visual hierarchy of pricing information has become a compliance minefield. If your base price is displayed in 48-point font while the total cost appears in 12-point text three clicks later, your design team may have inadvertently created a regulatory violation.

Cross-Department Coordination: This rule forces unprecedented collaboration between marketing, legal, product, and customer service teams. Everyone from the growth marketer running Facebook ads to the support agent handling refund requests needs to understand the new transparency standards.

The Enforcement Reality Check

The FTC isn't known for gentle reminders. Companies violating this rule face enforcement actions, financial penalties, and potentially devastating forced refund programs. More concerning for brand managers, violations become public records that competitors and consumer advocacy groups will eagerly weaponize.

Early indicators suggest state attorneys general and consumer protection agencies are already using this federal rule as a template for expanded local enforcement. What starts as FTC oversight could quickly multiply into a patchwork of state-level compliance requirements.

What Next?

Here’s how you can get ahead of this:

Complete pricing audit: Review every customer touchpoint where pricing appears—email campaigns, social media ads, landing pages, mobile apps, and checkout flows

Establish legal-marketing workflows: Create approval processes that ensure all promotional materials meet transparency requirements before launch

Eliminate ambiguous fee language: Replace generic terms like "service charges" with specific explanations of what customers receive for their payment

Turn compliance into competitive advantage: Early adopters are discovering that transparent pricing can actually improve conversion rates by building consumer trust

Educate customer-facing teams: Ensure support, sales, and success teams understand the new standards to maintain consistent messaging

Monitor competitor adaptations: Track how industry leaders are restructuring their pricing presentations to identify emerging best practices

The Transparency Dividend

While this rule initially feels like a constraint, forward-thinking marketing teams are already discovering unexpected benefits. Transparent pricing eliminates the customer skepticism that comes with hidden fees, potentially improving long-term brand loyalty and reducing support tickets related to billing surprises.

The companies that move beyond mere compliance to embrace genuine pricing transparency may find themselves with a significant competitive advantage in a market where consumer trust has become increasingly valuable currency.

The era of pricing hide-and-seek is over. The question now isn't whether to adapt—it's how quickly your team can turn regulatory compliance into a strategic marketing advantage.

Check out Tech Crunch for more details.

🤖↩️ Klarna's AI Reversal & How Virginia’s AI Law Would Reshape Compliance

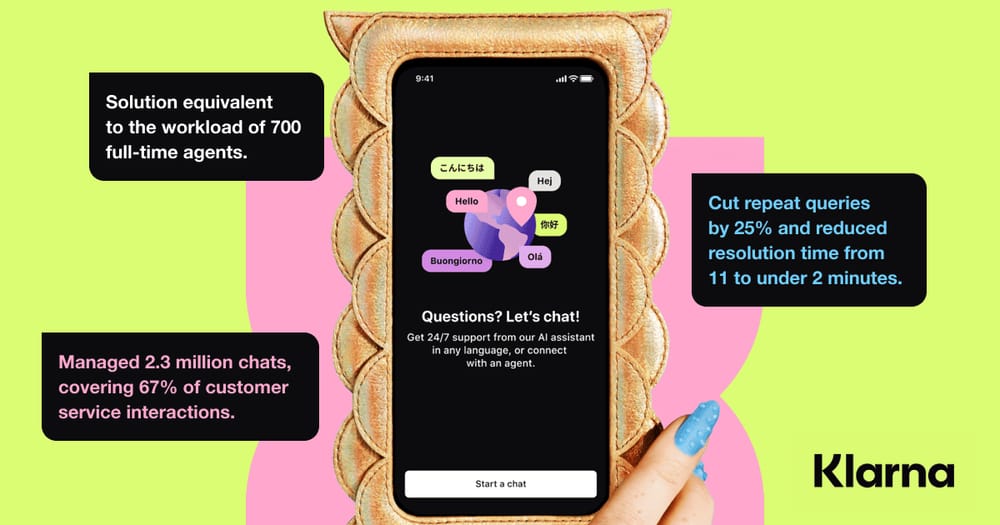

Just twelve months ago, Sebastian Siemiatkowski was the poster child for AI-powered workforce transformation. In a triumphant letter to Klarna shareholders, the CEO boasted that the company's AI assistant had successfully replaced 700 human employees—a technological feat that Wall Street analysts called "the future of customer service economics."

The numbers seemed to tell a compelling efficiency story. Klarna had methodically trimmed its workforce from 5,000 to 3,800 through "natural attrition," with Siemiatkowski boldly projecting a target of just 2,000 employees for the entire BNPL operation. The AI wasn't just handling routine inquiries—it was supposedly delivering the kind of sophisticated customer support that had previously required an army of trained representatives.

Tech blogs celebrated Klarna as a case study in smart automation. Venture capitalists pointed to the company as proof that AI could deliver immediate, measurable ROI. For a brief moment, it looked like Siemiatkowski had cracked the code on scalable customer service.

Then reality called.

The Quality Reckoning

In a candid Bloomberg interview that reads like a corporate mea culpa, Siemiatkowski delivered the kind of honest assessment that few CEOs are willing to make publicly: "The strategy has gone too far."

The confession reveals a truth that many AI-first companies are discovering the hard way. When cost reduction becomes the primary metric for measuring AI success, quality becomes the casualty. Klarna's AI assistant might have been handling the volume of 700 employees, but it wasn't delivering the nuanced problem-solving, empathy, and complex reasoning that human customers actually need when financial transactions go wrong.

"As cost unfortunately seems to have been a too predominant evaluation factor when organizing this, what you end up having is lower quality.”

It's a remarkably vulnerable statement from a CEO who built his reputation on technological disruption.

The CEO now argues that "really investing in the quality of the human support is the way of the future" for Klarna. The company is testing what it calls an "Uber-type setup" for customer service representatives—a distributed workforce model that allows human agents to work remotely while maintaining the flexibility and scalability that made AI attractive in the first place. It's hybrid thinking that acknowledges both the efficiency gains of technology and the compliance requirements of human oversight.

Perhaps most tellingly, Siemiatkowski now frames human availability as a brand differentiator: "From a brand perspective, a company perspective, I just think it's so critical that you are clear to your customer that there will be always a human if you want."

The Regulatory Reality Check

Klarna's pivot arrives just as lawmakers are waking up to the risks of AI deployment in financial services. Virginia's newly passed High-Risk Artificial Intelligence Developer and Deployer Act represents the second comprehensive state-level attempt (following Colorado) to regulate AI systems in "critical consumer-facing contexts"—including financial and lending services.

The timing couldn't be more pointed. While Klarna was automating away human oversight, Virginia legislators were crafting rules that specifically target AI systems used to make decisions that are a "substantial factor" in consumer financial outcomes. The law establishes sweeping obligations for AI deployers, including mandatory risk mitigation programs, impact assessments, and clear consumer disclosures.

Perhaps most critically for companies like Klarna, the Virginia law demands transparency about AI deployment—consumers must be told when they're interacting with artificial intelligence in high-stakes financial contexts. This strikes directly at the heart of "invisible AI" strategies that many fintech companies have embraced.

Virginia's law is part of a rapidly expanding regulatory patchwork. In 2024 alone, 45 states introduced AI-related legislation, with 31 states actually enacting new rules or resolutions. California, Connecticut, and Texas have already implemented AI statutes, and more comprehensive regulations are anticipated in 2025.

For financial services companies, this creates a complex compliance environment where AI deployment decisions must account for multiple state jurisdictions with varying requirements. The Virginia law's enforcement mechanism—up to $7,500 per violation through Attorney General action—ensures that compliance failures carry real financial consequences.

The law also establishes developer liability, requiring AI creators to exercise "reasonable care" against algorithmic discrimination and provide deployers with detailed usage guidelines. This means fintech companies can't simply blame their AI vendors when systems fail—they're jointly responsible for compliance outcomes.

However, as we covered last week, State laws like VA may being going away soon.

Strategic Implications for Fintech Leaders

Disclosure is the New Competitive Advantage: As AI transparency becomes legally mandated, companies that proactively communicate about their AI usage—like Klarna's new emphasis on human availability—may build stronger consumer trust than those that wait for regulatory enforcement.

Hybrid Models Become Compliance Necessities: The most sustainable AI strategies aren't just about customer experience—they're about maintaining human oversight capabilities that satisfy regulatory requirements while capturing automation efficiencies.

Klarna's pivot represents more than just a tactical adjustment—it's a recognition that sustainable fintech innovation requires balancing efficiency with regulatory compliance. The company's willingness to publicly acknowledge the limitations of its AI-first approach may actually strengthen its competitive position as new disclosure requirements favor transparent communication about AI deployment.

For other fintech companies watching Klarna's journey, the message is clear: the goal isn't to automate as quickly as possible, but to create compliant hybrid systems that leverage the best of both human and artificial intelligence while satisfying emerging regulatory expectations.

More coverage: Finextra & SheppardMullin.

Tune In: Marketing Under Fire: Surviving the CFPB’s New Era [Webinar]

May 29 @ 3 pm ET | LinkedIn

We’ll cover:

- What the BNPL rollback means for marketing claims and disclosures

- How state regulators and advocacy groups are stepping into the vacuum

- Common compliance risks that are still getting flagged

- How leading fintech teams are adjusting review processes with AI

If you’re responsible for customer-facing content in financial services, this is a session you won’t want to miss.

RSVP on LinkedIn.

💬 We’re launching a community for Marketing, Compliance, and Legal teams to stay up to date on regulatory changes—and help each other navigate them.