Hi Marketing Wranglers,

Welcome to another new week. This week, we’re diving into the latest shake-ups in crypto and fintech—from the SEC’s meme-fueled pivot to Trump’s Bitcoin power play to Robinhood’s latest regulatory drama—giving you the insights you need to stay ahead.

🚨 In This Week’s Issue

🔥 MemeCoin Mayhem: SEC Lets the Memes Run Wild!

🚀 Crypto Carnival: Trump’s Bold Bitcoin Boost!

🎢 Robinhood's Regulation Rumble: 2025’s Wild Ride

🔥 MemeCoin Mayhem

The SEC dropped a bombshell recently; memecoins, those quirky digital assets making headlines, aren’t considered securities.

In plain language? They’re not under the same strict regulatory radar as other investment products.

This decision, grounded in a nearly century-old Supreme Court ruling, marks a shift from the aggressive stance we saw under SEC Chair Gary Gensler and aligns more with the light-touch regulatory approach championed by President Trump (or the self-proclaimed “Cypto President”).

What’s Behind the Decision?

Memecoins have captured public imagination with their fun, irreverent approach to finance. Remember President Trump’s own memecoin, $Trump, which made waves during pre-inaugural festivities last January? Despite its wild value swings and hefty trading fees that raked in cash, the SEC’s new policy doesn’t single out any particular coin even though it clearly acknowledges the inherent risks for investors.

This shift aligns closely with the light regulatory approach championed by President Trump during his campaign.

It’s a far cry from the previous era when digital assets were largely lumped into the securities category.

Now, memecoins can operate outside of strict federal securities laws, at least for now. However, the SEC is quick to remind us that any fraudulent behavior related to the promotion or sale of these digital novelties will still be met with robust enforcement from other federal or state agencies.

What Does This Mean for Fintech Marketing?

For marketing professionals in fintech, this ruling opens up new creative avenues and new compliance challenges. Here’s why this matters:

A Playground for Creativity: With memecoins no longer boxed in as securities, marketers have more leeway to craft campaigns that tap into the meme culture and the viral potential of these digital assets. It’s an invitation to think outside the box and bring a sense of fun to your marketing strategy.

Compliance Isn’t Off the Table: Even if memecoins themselves escape securities regulation, the SEC has made it clear: if your marketing campaign crosses the line into fraudulent conduct, you’re still in trouble. This means that while your creative campaigns can be bold and playful, they must also be grounded in honesty and transparency. Marketers need to strike a balance between engaging storytelling and adhering to the spirit of the law.

Industry Ripple Effects: The SEC’s actions aren’t stopping at memecoins. The agency recently dismissed its enforcement lawsuit against Coinbase and is winding down investigations into several crypto companies. For marketers, this signals a broader shift in regulatory focus - one that may allow for more innovative, less cumbersome approaches to digital asset promotion. However, with this newfound freedom comes the responsibility to maintain ethical marketing practices.

Navigating Investor Risk: The SEC’s policy acknowledges that investors still face risks when putting money into memecoins. As a marketer, this means you have a duty to inform your audience of the risk clearly and accurately, ensuring that excitement doesn’t cloud the potential downsides. Transparency is not just good practice, it’s a crucial component of marketing compliance.

Looking Ahead

As the SEC continues to refine its stance and keep an eye on any new products trying to ride the memecoin wave, staying informed and adaptable is key. For marketers, this means keeping a pulse on both regulatory developments and the latest trends in digital culture.

So, as you plan your next campaign or tweak your current strategies, remember: in the world of fintech marketing, it’s all about playing smart. Embrace the fun and creativity that memecoins inspire, but always ensure that your messaging is as robust and transparent as the technology behind it.

Read more on The NY Times

🚀 Crypto Carnival: Trump’s Bold Bitcoin Boost!

On his very first day in office, Trump made a jaw-dropping promise: by midyear, Bitcoin would finally get the regulatory clarity it needed. And he wasn’t messing around. With a powerful executive order on January 23, Trump rallied the nation’s top policymakers—from the Treasury to the SEC, CFTC, and even the Attorney General—to blend digital assets seamlessly into the traditional financial system. This move marks the most aggressive pro-crypto push in Bitcoin’s history.

A Regulatory Shake-Up

Acting SEC chair Mark Uyeda quickly dismantled old rules like SAB 121—which had once forced banks to keep crypto off their balance sheets—making crypto custody much more practical. This early win has set the stage for a fresh, innovative approach to crypto regulation.

Wall Street Joins the Party

The SEC’s green light on spot Bitcoin ETFs on January 14, 2024, has unlocked a floodgate of institutional interest. In less than a year, these ETFs have raked in a staggering $113 billion, with BlackRock’s iShares Bitcoin Trust hitting a record $53 billion in assets in just six months. Bitcoin is no longer just a speculative bet—it’s rapidly emerging as a key portfolio diversified.

While crypto custody was once the exclusive domain of crypto-native firms like Coinbase, traditional powerhouses like Citi and State Street are gearing up to offer their own crypto custody services next year. This move is a game changer, promising a safer, more cost-effective way to manage digital assets without the old limitations.

A Shift in Perspective:

Gone are the days when Bitcoin was dismissed as “rat poison squared” (yes, Warren Buffet said that) by some of Wall Street’s most outspoken critics. Today, major institutions like BlackRock, Fidelity, and Morgan Stanley are not only offering Bitcoin ETFs but also integrating digital assets into employer 401(k) plans. Even conservative investors are starting to see Bitcoin as an essential asset, prompting a sea change in how digital currencies are viewed.

Global & State-Level Moves

The crypto craze isn’t confined to Wall Street. States like Texas, Pennsylvania, and Florida are already exploring ways to integrate Bitcoin into their treasuries, and global giants—from Abu Dhabi’s Mubadala Investment Company to Norway’s Government Pension Fund—are making significant moves in the crypto space. Rumors even swirl about a potential national Bitcoin reserve—a nod to the strategic energy reserves of the past.

The Bottom Line

What began as a bold executive order is now a full-blown crypto carnival. Bitcoin ETFs have pulled in $10 billion in just three trading days—an explosive growth rate that puts traditional assets like gold to shame. This isn’t just hype; it’s a monumental shift, turning a niche digital asset into a mainstream financial powerhouse.

Read more on Forbes

🎢 Robinhood's Regulation Rumble: 2025’s Wild Ride

2025 has been a wild regulatory rollercoaster for Robinhood.

In January, the SEC hit them with a $45 million fine. Robinhood was found to have 10 separate securities law violations by two of its broker-dealers—issues ranging from off-channel communications slip-ups to glaring cybersecurity vulnerabilities. Not exactly the kind of news you want so close to the first of the year.

A Glimmer of Relief

February brought a bit of a breather. The SEC dropped its investigation into Robinhood’s cryptocurrency business—a move that speaks to the loosening of the cypto regulatory environment that we covered above. For a moment, it felt like the ride might smooth out for Robinhood.

Yet, not so fast:

In March, FINRA announced a $30 million penalty (a $26 million fine plus $3.75 million in restitution) after uncovering issues like the secretive “collaring” of market orders, which left some customers in the lurch when re-entering orders. Add in concerns about anti-money laundering programs, outdated supervision of clearing tech, lax reporting, and even a misfire with social media influencers (I’ve seen this story before), and Robinhood’s regulatory toll soared.

A Cautionary Tale:

While Robinhood has self-reported some missteps and now claims to have remediated the issues, this wild ride is a stark reminder for all of us in fintech: innovation must go hand-in-hand with strict adherence to compliance.

This isn’t Robinhood’s first rodeo—remember the $70 million FINRA fine in 2021 and the $65 million SEC settlement in 2020, not to mention smaller penalties in 2024? Each chapter of this saga underscores one fact: in the rapidly evolving world of fintech, staying ahead means keeping a close eye on the regulatory track.

As Bill St. Louis, FINRA’s EVP and Head of Enforcement, put it, “Compliance with core regulatory obligations remains critical to safeguarding and serving all investors.”

Read more here on Investment News.

💬 Your Input Matters

I want to make this newsletter as valuable as possible for you. What regulatory trends are you concerned about? Hit reply and let me know—I read every response!

Austin Carroll, CEO

Warrant

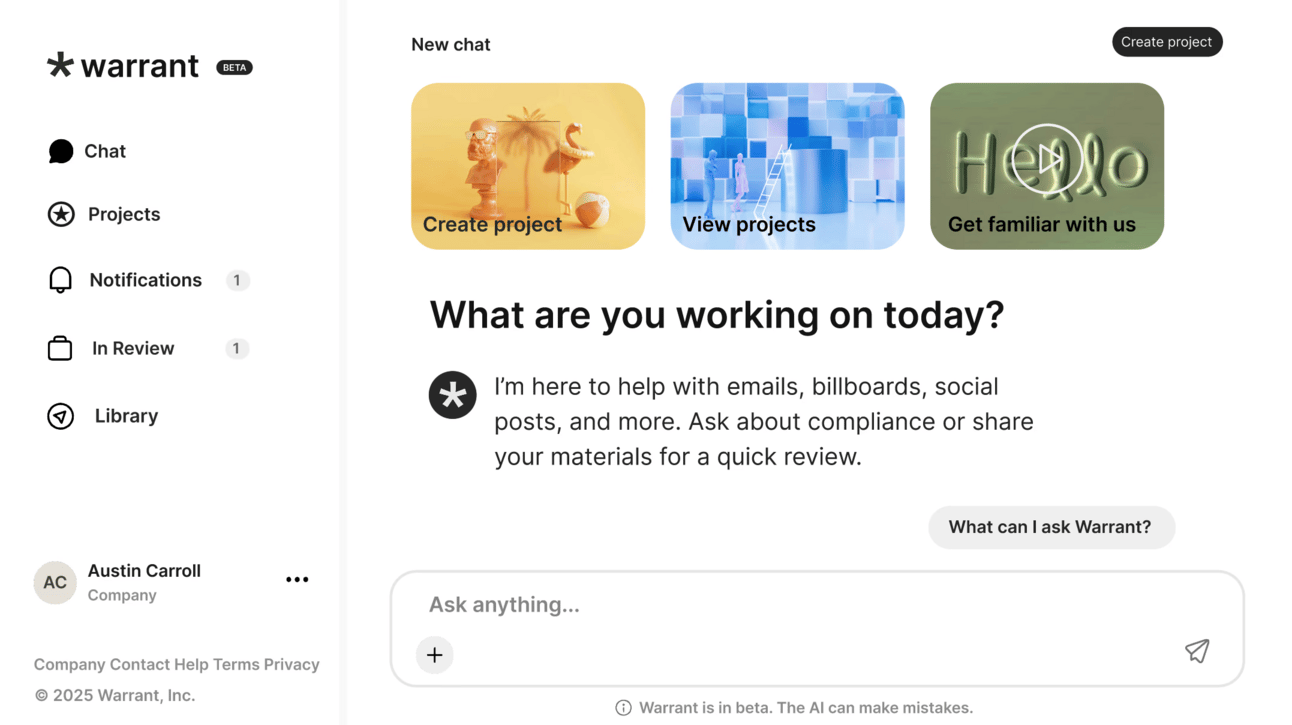

Ready to put marketing compliance on autopilot?

At Warrant, we are the first AI agent for marketing and communications compliance. Book a call with us here to learn how we can help your business.