Hi Marketing Wranglers,

From legal shake-ups to cinematic ad campaigns, this week’s headlines offer a mix of high-stakes drama and marketing lessons.

Trump’s crackdown on Perkins Coie could reshape legal practices in the US, Hollywood’s latest ad stunt blurs the line between commercials and entertainment, and the Trump Organization’s lawsuit against Capital One raises big questions for financial institutions.

🚨 In This Week’s Issue

💥 Trump’s Executive Order Targets Law Firm Perkins Coie: What It Means For Law Firms

🔥 Partnership Stunt Work Steals The Show: How Next-Level PaStorytelling is Shaping Advertising

🏛 Trump vs. Capital One: Why This Lawsuit Could Reshape Banking & Corporate Risk

🏛 Musk vs. the Regulators: Continuing Coverage on X Becoming a Bank and Elon’s CFPB Aims

💥 Trump’s Executive Order Targets Law Firm Perkins Coie

Trump just dropped an executive order taking direct aim at Perkins Coie, the law firm he’s long blamed for going after him. He’s cutting their security clearances, banning them from federal buildings, and freezing them out of government work.

It’s a major escalation—harsher than his recent move against Covington & Burling, who repped Special Counsel Jack Smith (the guy behind multiple indictments against Trump). This time, it’s personal.

Trump’s beef with Perkins Coie goes way back. The firm helped fund the infamous Steele dossier in 2016—the collection of unverified dirt compiled by ex-British spy Christopher Steele, alleging Trump had shady ties to Russia. Trump’s been calling it a political hit job ever since.

Now he’s accusing Perkins Coie of “dishonest and dangerous” lawyering. What happens next? Unclear. But the message is loud: Trump is reshaping the very practice of law.

A Crackdown on Legal and Business Practices

The executive order doesn’t stop at security clearances and contracts—it also takes direct aim at the firm’s hiring policies. It mandates a federal review into whether law firms, including Perkins Coie, engage in discriminatory hiring practices based on race or political affiliation. The review will examine whether large law firms:

Reserve jobs or promotions for individuals of specific races

Offer client services in a selective or discriminatory manner

Provide event access, training, or travel based on diversity policies

Bottom line? This could crack open a whole new front in the war on corporate diversity programs.

What Does This Mean?

This executive order doesn’t just affect law firms—it has broader implications for businesses that interact with government agencies or operate in highly regulated industries.

1. Watch The Cases You Hang Your Hat On

Law firms, banks, and big companies might want to think twice before flaunting their legal or political alliances in advertising . Loudly backing hot-button cases or regulatory fights could land them on the government’s radar—and not in a good way. In this climate, advertising your ties to controversy might be more trouble than it’s worth.

2. Increased Scrutiny on DEI and Hiring Practices

With the order turning a spotlight on hiring practices outside of just federal agencies, DEI programs are officially on notice. If you’re a law firm, bank, or any business chasing federal contracts, you might want to rethink how loudly you’re broadcasting your diversity creds. Job posts, marketing fluff, compliance docs—everything’s fair game for scrutiny now.

3. Careful Of Who You Know

Check your roster. Partnering with lobbyists, lawyers, or firms in the crosshairs of executive actions could put a target on your back.

A Changing Game

Trump’s order isn’t just another legal beef—it’s a warning shot. Government meddling in corporate and legal biz is on the rise, and if you’re not ahead of it, you’re behind. Companies and law firms need to tighten up their compliance game and rethink how they talk about themselves if they want to stay out of the crossfire.

In today’s world, risk management isn’t just about following the rules—it’s about protecting your reputation, your deals, and your firm’s future.

Read more on The New York Times.

🔥 Partnership Stunt Work Steals the Show

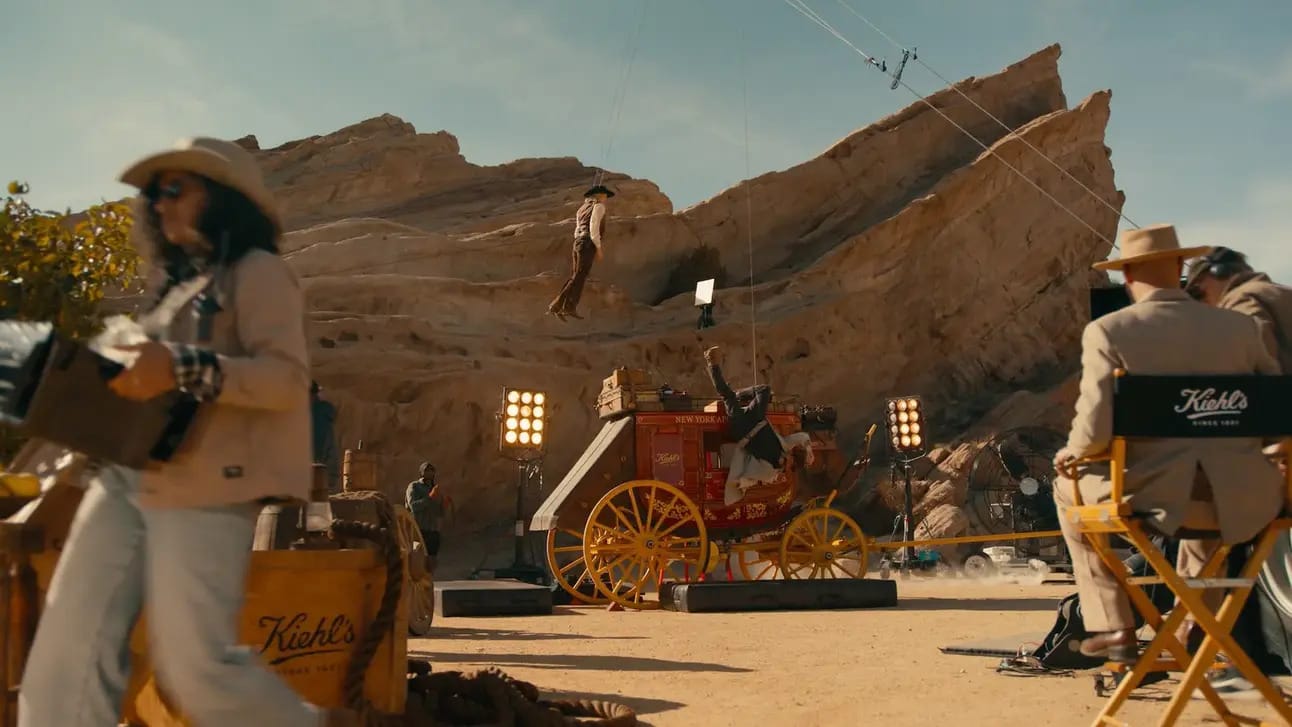

Kiehl’s Western-inspired Oscars ad spot (Vincent Peone)

While Hollywood was busy handing out Oscars, the real showstoppers were in the commercial breaks. A wild, adrenaline-pumping ad campaign featuring Samsung, Carnival Cruise Line, Kiehl’s, L’Oréal Paris, and ad-tech player Mntn turned the 97th Academy Awards into a full-blown action flick.

This six-spot thrill ride—courtesy of Disney Advertising, Kimmelot, and Ryan Reynolds’ Maximum Effort—wasn’t just hawking products. It was a high-octane shoutout to the stunt pros who make movie magic happen. Think aerial jumps, glass-smashing stunts, and car chases... all crammed into ads that felt more blockbuster than commercial.

A Tribute to Stunt Performers

With over 75 stunt pros in the mix, this campaign didn’t just sell products—it made a statement. It spotlighted the grit, skill, and flat-out guts it takes to pull off the jaw-dropping action we all love. Stunt coordinator Chris Denison called it a “love letter to the stunt community,” and honestly, it’s about time.

Actors get trophies. Directors get standing ovations. Stunt performers? Still waiting for their Oscars category—despite years of fighting for it. While the Academy toasted Hollywood’s best, this campaign threw down its own gauntlet: it’s time to give stunt crews the spotlight they’ve earned.

After a few months of “safe" ads given the political climate, it was great to see multiple bands take a statement and demand recognition.

Why This Matters for Marketing and Brand Storytelling

Authenticity Wins: Consumers crave stories that feel immersive and real. By spotlighting the stunt community, these brands tapped into the emotional and human side.

The Line Between Ads and Entertainment Is Blurring: High-production commercials aren’t just interruptions anymore—they’re part of the entertainment. As audiences get savvier, brands need to create content that holds attention just as well as the shows they air alongside.

Experiential & Partnership Marketing Is Taking Over: From real-life stunts to interactive multi-brand experiences, marketing is shifting toward campaigns that go beyond traditional ads. Expect to see more brands partnering together to cut through the noise.

Read more on Marketing Dive.

🏛 Trump vs. Capital One

Just when Capital One thought it was in the clear—fresh off the CFPB dropping its case—the bank is back in the hot seat. This time, it’s the Trump Organization coming for them, suing over what they call the “unjustifiable” shutdown of 300+ accounts holding millions. The claim? That Capital One pulled the plug right after January 6, 2021, causing financial fallout for Trump’s empire, its properties, tenants, and employees.

Trump and his crew say this isn’t just bad banking—it’s (ironically) a violation of consumer protection laws. And now they’re making an example out of Capital One, sending a loud message to any other financial institution that cut ties post-January 6: think twice.

Capital One swears politics had nothing to do with it. But after dodging the CFPB, they’re now stuck dealing with Trump’s latest legal blitz right in the middle of trying to get federal approval for its big merger with Discover.

What Does This Mean?

💰 Financial Institutions on Edge: The case raises concerns about whether banks will face legal consequences for distancing themselves from politically controversial figures. If successful, this lawsuit could discourage banks from making similar decisions in the future.

🏛 Regulatory Conflicts: With Capital One needing regulatory approval for its merger, the lawsuit adds an extra layer of complexity. Could Trump’s administration have indirect leverage over the bank’s future?

📉 A Business Risk for Trump’s Empire: While the Trump Organization is pushing forward with expansion, its legal battles with banks could make securing new financial partnerships more difficult.

As this case unfolds, it will test the intersection of business, politics, and banking in a post-January 6 world. With Eric Trump hinting at “more to come,” this legal battle may just be the beginning.

Read more on NY Times.

🏛 Musk vs. the Regulators

Elon Musk has never been one to play by the rules—especially when they slow him down. So when the CFPB dropped a new rule in November 2023 to slap banking-style regs on digital payment apps, Musk didn’t just push back. He went full Musk and called for the entire agency to be “deleted.”

Now? The Senate just voted to kill the rule. Big win for Musk. Platforms like X, Venmo, and CashApp are breathing easier without federal oversight cramping their style. But for consumers? Jury’s still out.

Without these protections, payment apps can skip stricter fraud rules and refund policies. Translation: faster innovation, but users could be left holding the bag on scams and surprise fees. Critics say it’s a risky bet—move fast, but break consumer trust along the way.

For fintech marketers, fewer federal rules mean more room to get creative—but state regulators and watchdogs are lurking. Transparency and recordkeeping isn’t optional; it’s survival (especially if we’ll see a reverse in 4 years).

The CFPB may have taken the L, but the battle over fintech regulation is far from over.

Stop stressing about marketing compliance.

At Warrant, we help your marketing and customer-facing teams stay compliant while streamlining approvals and recordkeeping. Book a call with us here.

Discover 100 Game-Changing Side Hustles for 2025

In today's economy, relying on a single income stream isn't enough. Our expertly curated database gives you everything you need to launch your perfect side hustle.

Explore vetted opportunities requiring minimal startup costs

Get detailed breakdowns of required skills and time investment

Compare potential earnings across different industries

Access step-by-step launch guides for each opportunity

Find side hustles that match your current skills

Ready to transform your income?